Women and children have been the most impacted by the current humanitarian crisis in Afghanistan.

A year on from the Taliban takeover in Kabul, Afghanistan is gripped by “cascading crises”, including a crippled economy that humanitarian aid alone cannot address, according to a new report from the UN Development Programme (UNDP) on Wednesday.

It says that the already-declining regular economy, as opposed to the black market, lost nearly $5 billion after August 2021 and is reversing “in 12 months what had taken 10 years to accumulate.”

Soaring prices

The cost of a basket of essentials needed to avoid food poverty has meanwhile risen 35 percent, forcing poorer households to go deeper into debt or sell off assets, just to survive.

Nearly 700,000 jobs have vanished, said UNDP, further threatening a population reeling from impacts of the COVID-19 pandemic, conflict, drought, and war in Ukraine.

“The Afghan people have been relentlessly subjected to extremely difficult circumstances. They have survived numerous challenges in the last 40 years and shown enormous resilience”, the report states, officially entitled, One Year in Review: Afghanistan Since August 2021.

“Yet the last 12 months have brought cascading crises: a humanitarian emergency; massive economic contraction; and the crippling of its banking and financial systems in addition to denying access to secondary education to girls and the restrictions on women’s mobility and participation in the economy”.

‘Strong response’ by UN

The head of UNDP, Achim Steiner, praised the UN’s “strong, coordinated response to the crisis” saying it proved critical in averting a catastrophe last winter.

“Building upon what worked last year including tailored efforts across multiple sectors to improve the livelihoods of more than half a million people, there is a pressing need to support further measures to prevent a deeper crisis.”

“We need to help Afghans cope with the coming winter including through our ABADEI programme which aims to support two million people with livelihood and job opportunities over the next two years – with a focus on particularly vulnerable groups such as women entrepreneurs and young people.”

Expanding connectivity

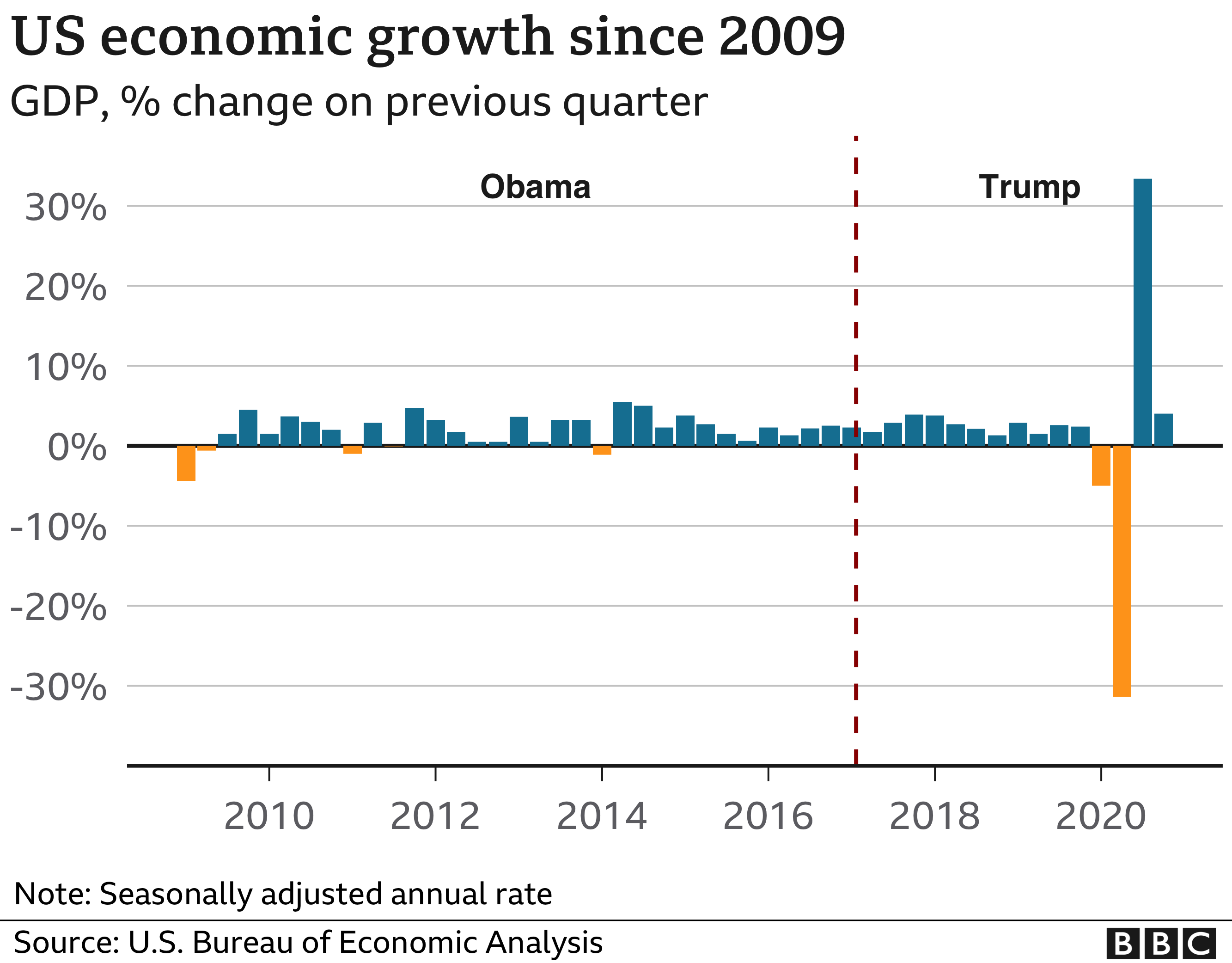

The report paints a bleak fiscal picture of the country, dating back more than a decade before the Taliban ascendency.

With GDP in steady decline since 2008, Afghanistan had come to rely on international aid to sustain its economy, which accounted for a staggering 75 percent of total Government spending and nearly 40 percent of GDP at the time of transition. But foreign donors largely suspended aid after the transition, UNDP notes.

Without support from outside, Afghanistan must now rely on limited domestic revenue from agriculture and coal exports.

Authorities have sought to address revenue shortfalls by cracking down on corruption in key revenue streams, such as customs, and by reaching out to the private sector and foreign investors.

“Two decades of heavy dependence on international aid and imports, a lack of industrialization and competitiveness, and limited mobility and connectivity among regions, among other factors, have hindered Afghanistan’s forward momentum,” the report says.

Cost of excluding women

UNDP analysis forecasts that restricting women from working can result in an economic loss of up to $1 billion – or up to five percent of the country’s GDP.

“The rights of women and girls are critical for the future of Afghanistan,” said UNDP Asia-Pacific Director Kanni Wignaraja. “It starts with education and continues with equal opportunity when it comes to employment and pay.

“UNDP made the support to women-owned businesses front and center of its aid activities: we provided support to 34,000 women-owned small businesses. Our goal is to reach 50,000 women-owned business by the end of this year.”

UNDP Resident Representative Abdallah Al Dardari said they was grateful for the $300 million in funding provided for the programme’s work on livelihoods as part of the overall crisis response, “but much more is needed for economic recovery”.

“Afghans are running out of time and resources. Afghanistan needs support from the international community to bring back to life local markets and small businesses which are the backbone of Afghanistan’s economy.”

Foto: Banco Mundial/Peter Kapuscinski / Mudança climática afeta também produção agrícola

Foto: Banco Mundial/Peter Kapuscinski / Mudança climática afeta também produção agrícola Pnuma/Lisa MurraySementes são chave para o incremento de 50% na produção agrícola

Pnuma/Lisa MurraySementes são chave para o incremento de 50% na produção agrícola